Irs w4 calculator

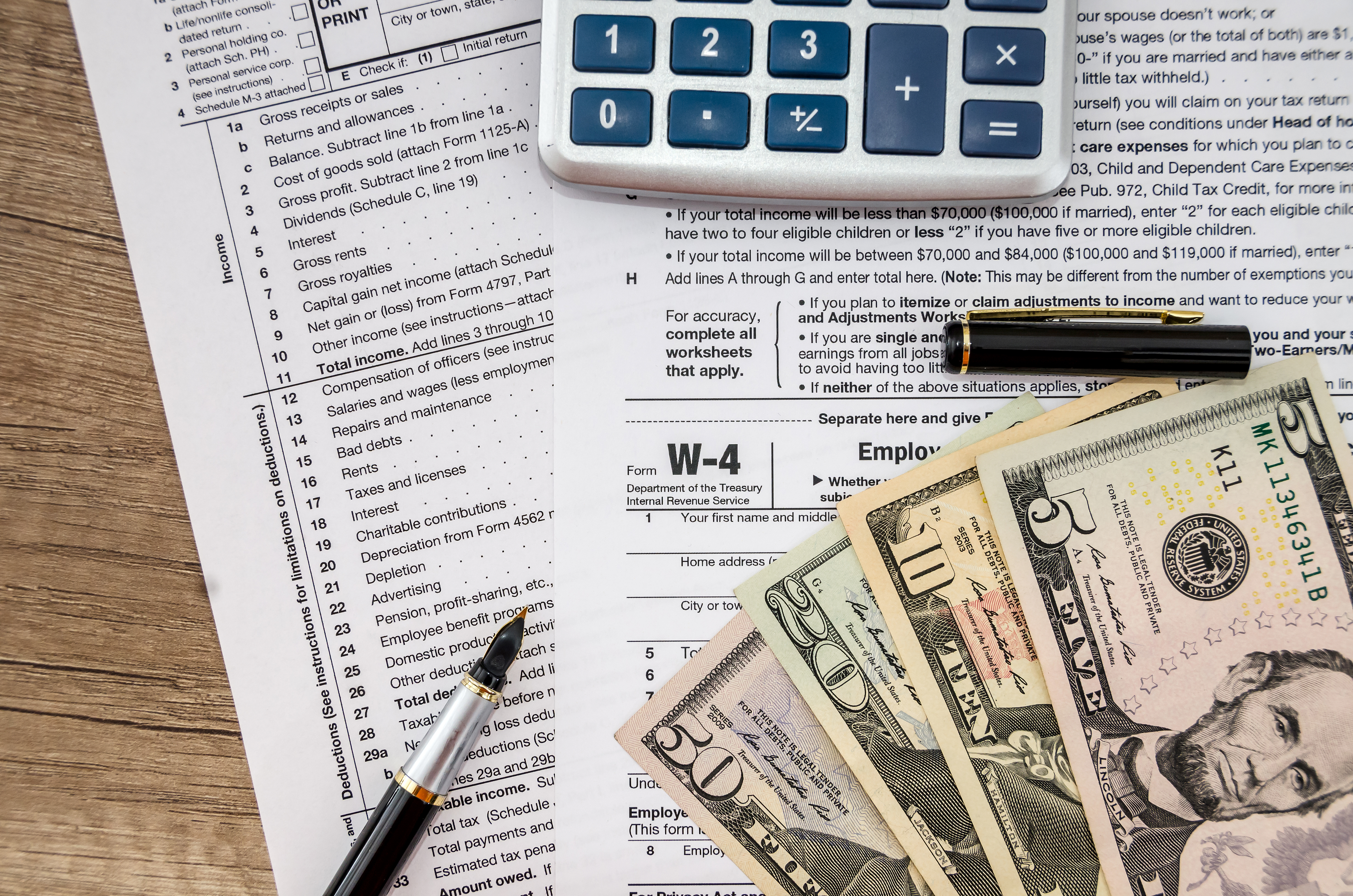

Our free W4 calculator allows you to enter your tax information and adjust your paycheck withholding to increase your refund or take-home pay on each paycheck by show you how to fill out your 2020 W 4 Form. Estimate your paycheck withholding with our free W-4 Withholding Calculator.

Test Your Knowledge Of The Irs Tax Withholding Estimator Bds Financial Network

An even easier way is to use the TurboTax W-4 Calculator.

. The IRS announced that they will be providing Covid tax relief for certain 2019 and 2020 Returns due to the pandemic. W-4 Pro Select Tax Year 2022. We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply.

RATEucator - Income Brackets Rates. It aligns with changes made by the 2017 Tax Cuts and Jobs Act TCJA. You may owe tax for 2021 if you claimed.

The Withholding Form. City or town state and ZIP code b Social security number. Consult with your tax professional.

Get 247 customer support help when you place a homework help service order with us. Updated for your 2021-2022 taxes simply enter your tax information and adjust your withholding to understand how to maximize your tax refund or take-home pay. Our withholding calculator doesnt ask you to provide personal information such as your name Social Security Number a ddress or bank account information.

IRS tax forms. Claiming zero allowances means less take home pay but a bigger tax refund during tax season. The IRS advises that the worksheet should be completed by only one of a married couple the one with the higher-paying job to end up with the most accurate withholding.

The IRS allows taxpayers to amend returns from the previous three tax years to claim additional refunds to which they are. Oregons withholding calculator will help you determine the number of allowances you should report on Form OR-W-4. The IRS issues more than 9 out of 10 refunds in less than 21 days.

According to the IRS website Understanding Your 5071C Letter this letter may be sent when the IRS needs more information to verify your identity in order to process your tax return accurately. Adjust your W-4 withholdings to get a bigger tax refund or a bigger paycheck. But the IRS introduced a new Form W-4 beginning with the tax year 2020 that can simplify the process a bit.

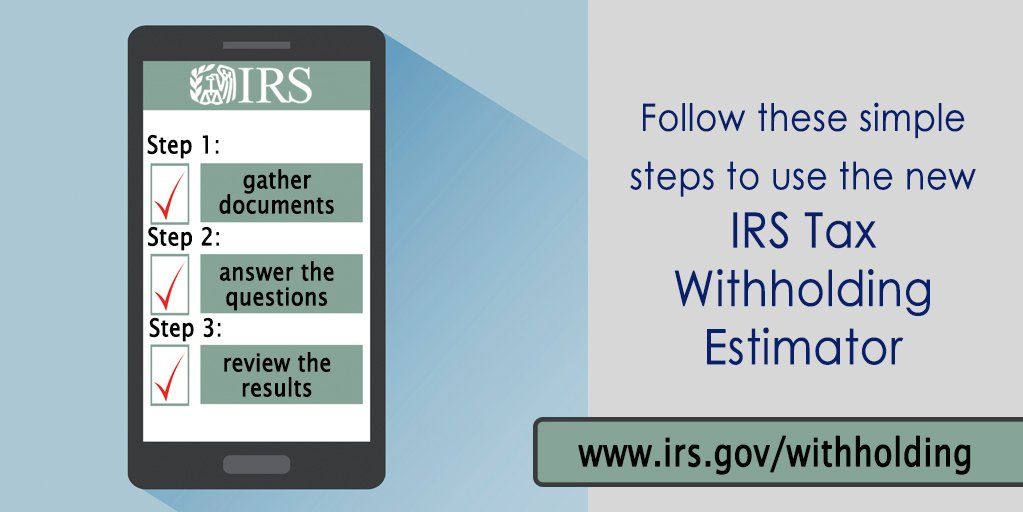

Visit the IRS withholding calculator. Receiving this letter DOES NOT necessarily mean your identity has been stolen but only that the IRS needs to verify your identity prior to completing the processing of your return. Continue through the screens entering the requested information.

Click Other Tax Situations. The IRS will be issuing refunds of up to 12 billion to a total of 16 million qualifying individual taxpayers Form 1040 and businesses Form 1120 who filed their 2019 or 2020 taxes late. Late last year I followed the W4 instructions entered that both my spouse and I have jobs that we have 2 dependent children and arrived at 4000 for dependents 2000 per dependent.

Print out the W-4 form and submit it to your employer. Complete Form W-4 so your employer can withhold the correct federal income tax from your pay. You should keep in mind that the withholding calculator will work for most but not all taxpayers.

A Special Note on the Withholding Calculator. W-4 Adjust - Create A W-4 Tax Return based. Your withholding is subject to review by the IRS.

Then click on the forms. The 2019 Calculator Help You Complete Your 2019 IRS Paper Tax Forms. Do you have an employment related question.

At this point use the 2019 Tax Calculator to assist you in completing your 2019 IRS Tax Forms for free. Just answer the questions and the withholding amount is computed for you. W-4 Adjust - Create A W-4 Tax Return based.

IRS Form 9465 - Installment Agreement Request - TaxAct. If not to ensure you get credit for your earnings contact. Based on the data entered and the tax refund amount shown at WPRO-10 above we suggest you reduce your tax withholding to.

The number you report on a W-4 will ultimately determine your take home pay and your tax refund. The new W-4 introduced in 2020 still asks for basic personal information but no longer asks for a number of allowances. Check out HR Blocks new tax withholding calculator and learn about the new W-4 tax form updates for 2020 and how they impact your tax withholdings.

Publication 505 Tax Withholding and Estimated Tax is available on the IRS web site. Enter Personal Information a First name and middle initial. Fees apply if you have us file a corrected or amended return.

The TCJA eliminated the personal exemption. W-4 Pro Select Tax Year 2022. 2021 2022 Paycheck and W-4 Check Calculator.

Form 1098-T - Entering in Program. Any resident who paid income tax to any other state that uses a convenience of the employer rule shall be allowed a credit against such residents Connecticut income tax for the tax paid to such other state on income earned by such resident while working remotely from this state for said taxable year including while obligated by necessity to work remotely from this. You can prepare a new W-4 in TurboTax by following these steps.

Use this tool to estimate the federal income tax you want your employer to withhold from your paycheck. Does your name match the name on your social security card. Now you can easily create a Form W-4 that reflects your planned tax withholding amount.

15 Tax Calculators. That prompted the IRS to change the W-4 form. If the result from the W-4 calculator is different from your current withholding ask your employer for a fresh W-4 form to fill out.

Maximize your refund with TaxActs Refund Booster. The results from the calculator arent saved. Check your tax withholding with the IRS Tax Withholding Estimator a tool that helps ensure you have the right amount of tax withheld from your paycheck.

Load and Complete the Forms Before You Mail Them to the IRS. Important IRS penalty relief update from August 26 2022. Last name Address.

In the Other Tax Forms section click the Start box next to Form W-4 and Estimated Taxes. Dont write down any number. Support Search Help Topics.

RATEucator - Income Brackets Rates. If you have a more complex tax situation you should look at IRS Publication 505 and follow the instructions there. WPRO-12 In addition to your current IRS tax withholding which is most likely based on your latest W-4 and based on your entries we suggest you withhold this additional tax amount in order to balance or reduce the taxes owed with your 2022 Tax Return.

Calculating a level of tax withholding thats just right can sometimes take as much time as preparing your tax return. 2022 Form W-4 Multiple. The design of the Form W-4 does not give you the actual tax withholding amount therefore we have created this paycheck and integrated W-4 calculator tool for you.

A great tool to help you while filling out a W-4 is the IRS Withholding Calculator located on the IRS website. Get your tax refund up to 5 days early. This simple tool makes determining your withholdings easy.

You will want to prepare new W-4s for all your jobs following the instructions or use the IRS online calculator. You can no longer e-File the Tax Year 2019 IRS andor State Income Tax Returns or forms. Did you find.

2

Irs W 4 Calculator On Sale 52 Off Www Ingeniovirtual Com

Federal Withholding Calculator Store 51 Off Www Ingeniovirtual Com

Irs Releases New Form W 4 And Online Withholding Calculator Rhsb

Irs Launches New Tax Withholding Estimator Redesigned Online Tool Makes It Easier To Do A Paycheck Checkup Where S My Refund Tax News Information

2

How To Calculate Federal Income Tax

How To Fill Out A W 4 Form And Keep More Money For Your Paycheck Student Loan Hero

Irs Releases New Form W 4 And Online Withholding Calculator Personal Wealth Strategies

W 4 Form Basics Changes How To Fill One Out

2020 W 4 Updated

Tax Withholding Estimator New Free 2019 2020 Irs Youtube

Irs Witholding Calculator

Irs Launches New Tax Withholding Estimator

Understanding Your W 4 Mission Money

Irs Improves Online Tax Withholding Calculator

United States How To Answer Irs Withholding Calculator Questions About 2018 Personal Finance Money Stack Exchange